WE DO STANDARD MORTGAGES TOO

At Roots Mortgages, we not only specialise in contractor and freelancer mortgages. Our capabilities also extend into traditional residential mortgages.

The world of contractor work and freelance work is very fluid and flexible. We understand that people shift from contract work to traditional payslip-based employment during their careers, including working via umbrella companies.

Such shifts can impact mortgage applications. It is therefore vital that if you have experience of both contractor and traditional employment, or are potentially looking to shift between the two in the future, you have a mortgage broker that understands both intimately.

At Roots Mortgages, we are able to support applicants with traditional residential mortgages. We can help you secure the perfect mortgage for your situation.

Our expertise spans across the mortgage industry. We can provide the kind of tailored support that can make a real difference.

By taking a flexible approach to the underwriting process, we can help give you the best chance of securing a mortgage that fits your personal and professional situation.

So while we pride ourselves on being able to provide the most suitable contractor mortgage and freelancer mortgage advice, our knowledge and expertise certainly extends into the realm of more traditional mortgages.

By taking the time to understand your specific situation and requirements, we can shape your mortgage applications to provide you with the best chance of securing the residential mortgage you seek.

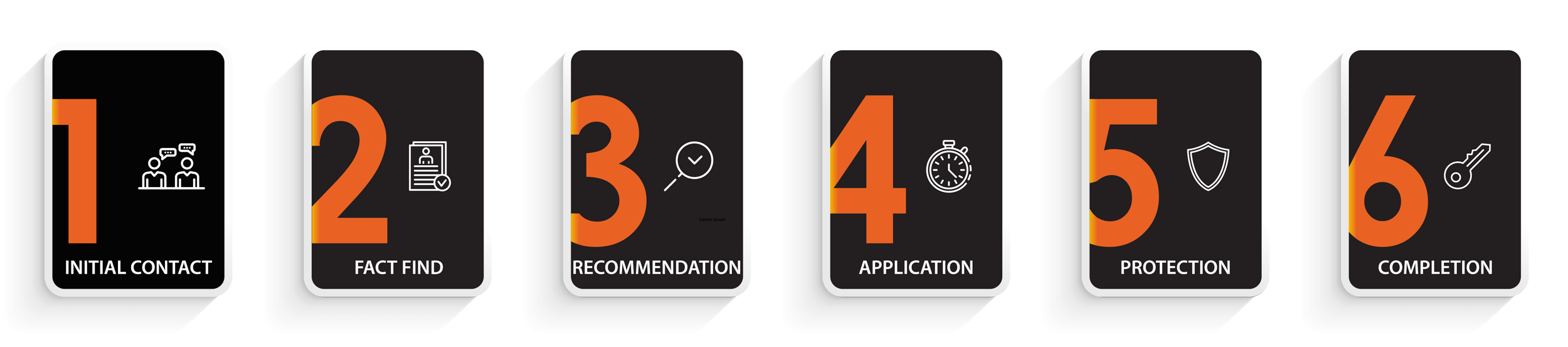

OUR MORTGAGES FOLLOW A SIMPLE 6 STEP PROCESS

CHOOSE ROOTS AS YOUR MORTGAGE BROKER

Our team fully understands what the world of contracting and freelancing entails, especially when you make the call to go back to being an employee and earn via PAYE.

Our aim is to address these difficulties and provide solutions. This allows you to secure the mortgage you want. Having a broker such as Roots Mortgages on your side during the mortgage process can help enhance the chances of you successfully securing the mortgage you want.

WE PLAY BY THE BOOK

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The fee is up to 1% but a typical fee is £650.