GETTING A MORTGAGE AS A FREELANCER

Freelance work is a hugely appealing option for professionals with a skill set that can benefit a number of end companies.

This way of working has grown in popularity in recent year, as more and more people have taken the freelancing ‘leap’.

The benefits of this type of work are substantial. Freelancers have the ability to pick and choose the work you do and the contracts you take up.

Pay can also be good. There is the potential for an array of income sources from companies taking advantage of the specific skill or service you can provide.

With such advantages, the rise of freelancing has been significant. But there are certain areas that have not kept up with this modern means of employment. One such area is mortgages.

Mortgage lenders will always seek to understand the risk on their part of lending to a specific applicant. To understand this risk, lenders will use a series of indicators about an applicant’s financial means and job security.

As a freelancer, providing the information around such indicators is not straightforward. This means some mortgage lenders will be reluctant to offer mortgages to freelance workers. This can result in the process of trying to secure a mortgage becoming problematic and frustrating for freelancers.

At Roots Mortgages, expert underwriters can bypass traditional means of assessment, such as payslip evidence of consistent income. This allows us to tailor our advice and guidance and support your application for a mortgage as a freelancer.

We have intimate knowledge of the mortgage market and the criteria by which lenders analyse the risk and suitability of freelance workers. This puts us in position to secure the perfect mortgage for your needs.

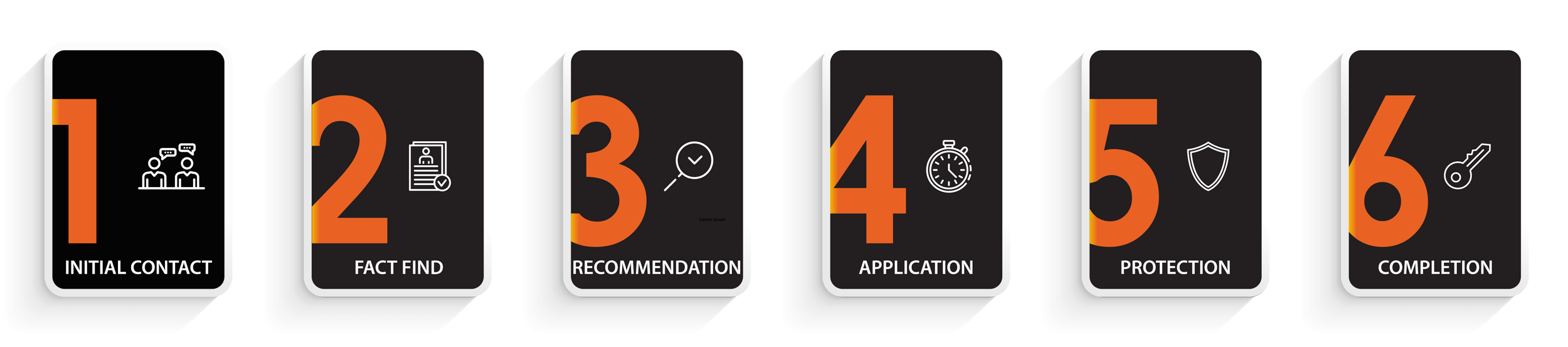

OUR MORTGAGES FOLLOW A SIMPLE 6 STEP PROCESS

CHOOSE ROOTS AS YOUR FREELANCER MORTGAGE BROKER

Our team not only understands what the world of freelancing entails, but some of the technical and logistical difficulties that this way of working, for all its benefits, can bring.

Our aim is to address these difficulties and provide solutions. This allows you to secure the mortgage you want. Having a broker such as Roots Mortgages on your side during the mortgage process can help enhance the chances of you successfully securing the mortgage you want.

WE PLAY BY THE BOOK

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The fee is up to 1% but a typical fee is £650.