GETTING A MORTGAGE WHEN WORKING AS A CONTRACTOR

We specialise in contractor mortgages. Why? Because everyday mortgages are not designed for contractors. They are aimed at company employees and are typically based on payslip earnings.

This way of calculating an applicant’s suitability for a mortgage is outdated and archaic. Modern employment methods and ways of working have changed.

You can earn substantial wages as a contractor and enjoy long periods of secure work. The way mortgages have traditionally been calculated does not account for this.

Having a trusted, committed contractor mortgage specialist on your side pays huge dividends. It could be the difference between getting a mortgage as a contractor, and hitting continuous hurdles and difficulties.

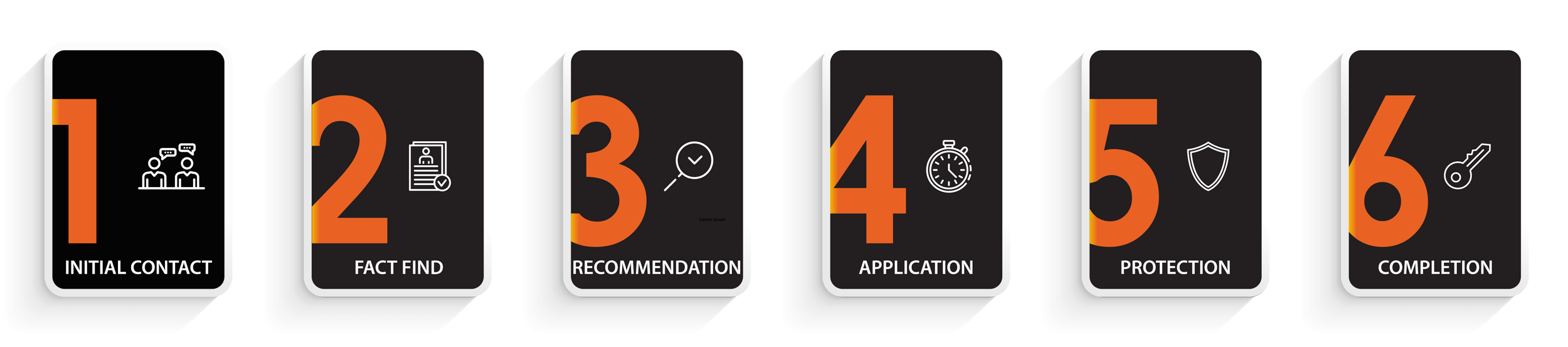

OUR MORTGAGES FOLLOW A SIMPLE 6 STEP PROCESS

EXPERTS IN THE SELF EMPLOYED MORTGAGE FIELD

At Roots Mortgages, we are experts in the field of contractor mortgages. We provide contractors with the guidance, support and advice they need to secure their perfect contractor-friendly mortgage.

We understand how lenders calculate mortgages and the way in which they analyse the income of a contractor.

Typically, lenders will seek to verify a contractor’s income by reviewing 2-3 years’ worth of accounts or tax returns. These reviews use specific criteria to determine the risk on the part of the lender for an applicant.

Unfortunately, this criteria all too often deems contractor workers as high risk. This is an inaccurate representation of the income and job security of contractors. But too many lenders have been slow to update their approach. Sadly, it is contractors that bear the brunt.

This means securing a mortgage as a contractor can prove troublesome. Having an expert team such as Roots Mortgages on your side can make the whole process easier. We can help you secure the most suitable contractor mortgage for you.

We do this by tailoring your applications based on your contractor employment model. Our role as a contractor mortgage broker sees underwriters bypass traditional means of assessment, such as payslip evidence.

Instead, we tailor our applications around specialist contractor-related criteria. This provides a better representation of your finances as a self-employed worker. This is done is by calculating gross earnings based on your current day rate – something that provides tangible affordability information to lenders. This allows lenders to calculate their maximum loan amounts, giving you the information you need to progress with your mortgage plans.

CHOOSE ROOTS AS YOUR CONTRACTOR MORTGAGE BROKER

Our team not only understands what the world of contracting entails, but some of the technical and logistical difficulties that this way of working, for all its benefits, can bring.

Our aim is to address these difficulties and provide solutions. This allows you to secure the mortgage you want. Having a broker such as Roots Mortgages on your side during the mortgage process can help enhance the chances of you successfully securing the mortgage you want.

WE PLAY BY THE BOOK

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The fee is up to 1% but a typical fee is £650.