MORTGAGES THAT MATCH HOW YOU WORK

Roots Contractor Mortgages is an expert in contractor and freelancer mortgages.

We have access to thousands of mortgages from more than 90 lenders.

We specialise in finding the perfect mortgages for those working as contractors and freelancers. Our team has an in-depth understanding of the intricacies of working in this way, and the challenges of securing mortgages when doing so.

Roots also offers residential mortgages via our sister company The Mortgage Lodge, so no matter what stage of contracting you are at, be it a complete newbie, a contractor with decades of experience, or someone looking to flex between contracting and employment we have a mortgage for you.

It doesn’t matter if you know the exact type of mortgage you want, or are a first time buyer, we’re here to help.

All of our advisors are available to guide you through your options and explain how the rest of process works in detail. All you need to do is book an initial appointment, at no cost at all, and they will walk you through everything. It couldn’t be more simple.

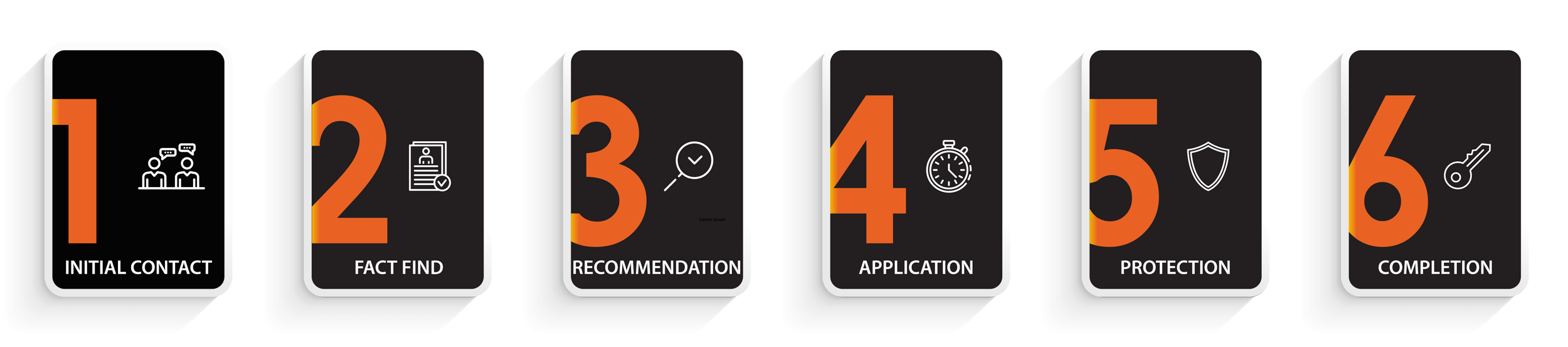

OUR MORTGAGES FOLLOW A SIMPLE 6 STEP PROCESS

We offer all customers a free no obligation appointment with a fully qualified mortgage advisor.

This is now often undertaken via telephone or video call, but on occasions can be done face-to-face. All appointments are at a time of your choosing, including weekends and out of office hours, where we get an initial understanding of your circumstances and advise on the range of options available specifically to you.

Follow up calls and discussions take place to get a full understanding of your unique circumstance, and when you decide the time is right we will make an application to the mortgage lender – it is only at this point will we charge a fee, and this will be clearly advised, communicated and agreed with you in advance.

Once the application is in, it only remains to ensure you, your family and property is protected. We offer a wide range of insurances, including life, critical illness and building & contents. Many customers overlook the protection element, meaning what is likely their largest debt in their lifetime (their mortgage) is at risk. We want to ensure that should the worst happen, you have the peace of mind that you and your loved ones are not left out of pocket.

To start the process of finding out how to get the finance for your dream house get in contact with Roots Mortgages today.

CONTRACTOR MORTGAGES

Everyday mortgages aren’t designed for contractors; they’re aimed at employees and based on payslip earnings…

FREELANCER MORTGAGES

Standard high street mortgages don’t get how freelancers operate; they only know employees who earn via payslips…

RESIDENTIAL MORTGAGES

We recognise that many customers switch between the contracting and freelancing life and being a standard employee…

WE PLAY BY THE BOOK

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The fee is up to 1% but a typical fee is £650.